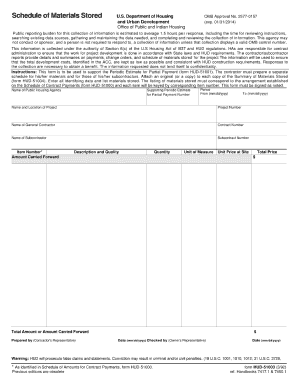

Who needs a Form HUD 51001?

Form HUD 51001 is the Periodic Estimate for Partial Payment designed by the U.S. Department of Housing and Urban Development (HUD). It should be completed by the Contractor for a specific construction project in order to certify that all items and their cost provided on this document are correct. This form also certifies that all work on the project has been done and material supplied in full accordance with the conditions of the contract signed between the project’s owner and the contractor.

What is Form HUD 51001 for?

The contractor/subcontractor reports provide detailed summary on payments and materials that were used for the specific construction project. The information provided on this form is used to certify that the project was development and done in accordance with State laws and HUD requirements.

Is Form HUD 51001 accompanied by other forms?

There is no need to accompany the form with any other documents. However, there is a rule that information provided in the “Item Number” and “Description of Item” sections must correspond to the appropriate data provided on the Schedule of Amounts for Contract Payments, Form HUD 51000 that must be filed before the project has been completed.

How do I fill out Form HUD 51001?

All identifying data is required. Periodic estimates must be numbered in sequence beginning with the number 1.

The following information must be specified in order to complete the form:

-

Name of Public Housing Agency;

-

Periodic Estimate Number;

-

Location of Project;

-

Name of Contractor;

-

Descriptions of Items;

-

Value of Contract Work Completed.

After the form is completed, the Certification of the Contractor or Duly Authorized Representative (which is the second page of this form) must be completed and signed as well.

Where do I send Form HUD 51001?

Once completed and signed, this form must be directed to the nearest HUD office.